You’ve got to spend money to make money.

That’s they say, right? And yet, for some small business owners, a generous marketing budget just isn’t in the cards.

You can skimp on marketing, but I’m willing to bet you haven’t considered something that you should be thinking about…

You know that it costs more to attract a new customer than it does to retain an existing one – but how much can you really afford to spend to attract a new customer?

Knowing the lifetime value of your customers is the key to creating a workable budget for marketing. That number should dictate how much you spend. Spend too much and you’re losing money in the long run. Spend too little – and you’re missing out on an opportunity to grow your business.

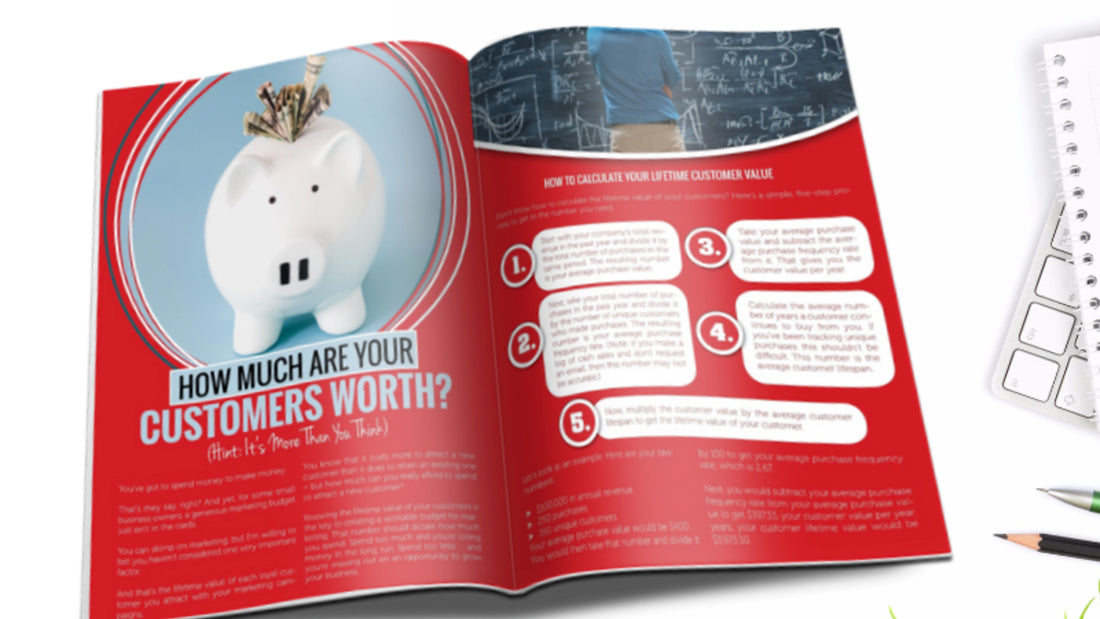

How to Calculate Your Lifetime Customer Value

Don’t know how to calculate the lifetime value of your customers? Here’s a simple, five-step process to get to the number you need.

- Start with your company’s total revenue in the past year and divide it by the total number of purchases in the same period. The resulting number is your average purchase value.

- Next, take your total number of purchases in the past year and divide it by the number of unique customers who made purchases. The resulting number is your average purchase frequency rate. (Note: if you make a log of cash sales and don’t request an email, then this number may not be accurate.)

- Take your average purchase value and subtract the average purchase frequency rate from it. That gives you the customer value per year.

- Calculate the average number of years a customer continues to buy from you. If you’ve been tracking unique purchases this shouldn’t be difficult. This number is the average customer lifespan.

- Now, multiply the customer value by the average customer lifespan to get the lifetime value of your customer.

Let’s look at an example. Here are your raw numbers:

- $100,000 in annual revenue

- 250 purchases

- 150 unique customers

Next, you would subtract your average purchase frequency rate from your average purchase value to get $397.33, your customer value per year. If you keep your customers, on average, for 10 years, your customer lifetime value would be $3,973.30.

That’s a very simple example but it illustrates the point. This business has a lifetime customer value of nearly $4,000.

How to use Customer Lifetime Value in Marketing

You know your customer lifetime value – now what?

The short answer is that you’ve got a piece of information that can help you attract more customers and make better use of your marketing budget.

But… what does that mean in practical terms? Here are some actionable ways to use your CLV to your advantage in marketing.

Identify Your Most Profitable Customers

If you’ve been tracking unique customer data, then it’s worth your time to crunch the numbers and learn about who your most valuable customers are.

For example, you might look at your LCV by:

- Age

- Gender

- Race

- Location

- Income

Identify Your Most Profitable Marketing Channel

You should also calculate your most profitable marketing channel based on the number of new customers you acquire.

Perhaps you have been running marketing campaigns on:

- Google AdWords

Increase Your New Customer Acquisition Spending

It costs more to attract new customers than to retain existing ones, but once you know your LCV, you may discover that your new customer acquisition spending is on the low side.

You don’t need to send your spending through the roof. However, you can and should look at what you’re spending compared to the LCV you’ve calculated. If you’re spending only a tiny fraction of the LCV to acquire a new customer, it may be worthwhile to spend a bit more in that area going forward.

Allocate Your Marketing Budget to Maximize Customer Value

Your lifetime customer value might not be as high as you want it to be. The good news is that there are things you can do to increase it.

For example, say that you have learned that the people who follow you on Facebook are your most engaged and profitable customers. That’s great information to have.

Instead of sinking money into something that might not be getting you a big return, you can allocate more of your marketing budget to Facebook. Some if may go toward attracting new customers, but you should also spend some trying to get existing customers to buy more frequently and spend more money.

One way to do that is to offer return customers discounts or to create a loyalty program. If you can inspire your existing customers to buy more often, then you’ll be driving up your LCV every time they do.

At the same time, incentivizing your existing customers may also attract new customers to your business. You can encourage your followers to invite their friends to your page or allow them to share a discount code or coupon with their friends.

Your Customers Are Valuable

Every customer you have contributes to your company’s success and profitability. Understanding just how much each customer is worth to you can help you do a better job of attracting new customers, increasing their lifetime value, and maximizing your profits.